2021 Is On Track To Become The Highest-Grossing Year In Gaming History, AGA’s Q2 2021 Tracker Suggests

By a Biometrica staffer

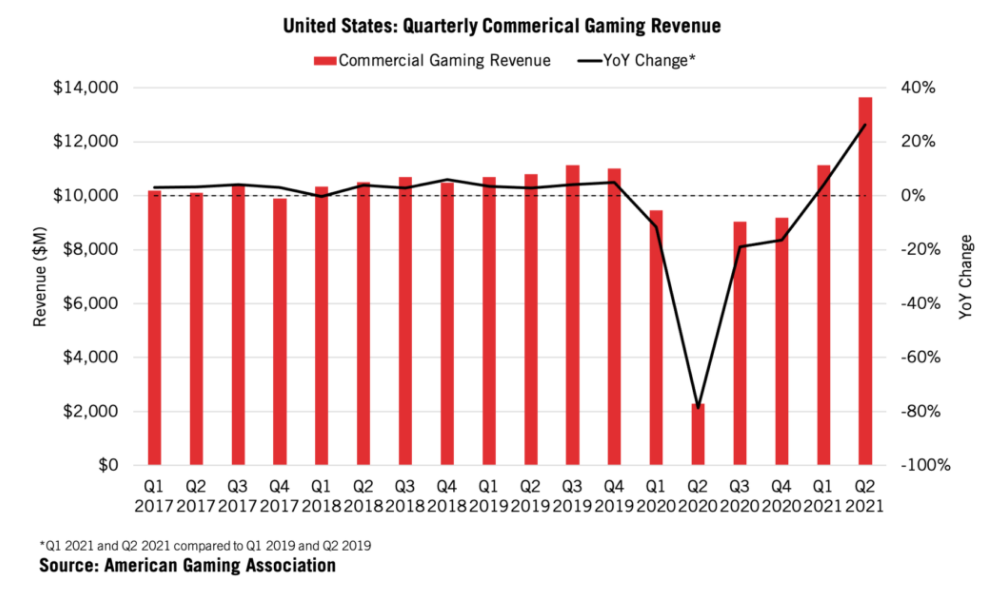

Nationwide commercial gaming revenue from traditional casino games, sports betting, and iGaming came in at $13.64 billion in the second quarter of 2021 (Q2 2021), smashing the industry’s previous best-ever record from Q3 2019 by a whopping 22.5%. It was the easing of Covid-19 related restrictions, rising vaccination rates, an increasingly optimistic economic outlook, and, of course, pent-up consumer demand that helped the casino industry in Q2, the American Gaming Association (AGA) said on Tuesday, Aug. 10, when it published its latest Commercial Gaming Revenue Tracker.

In May, we wrote about the casino industry bouncing back strong in Q1 2021 with commercial gaming revenue soaring in that quarter to $11.13 billion, and breaking all records at that point. Now with Q2 2021’s new record-setting streak, this year is likely to become the best ever in U.S. casino history if this blistering pace continues.

The industry generated $24.8 billion in revenue in the first six months of 2021. So, despite a slow start to this year because of lingering shutdowns and substantial operating restrictions early in the year to curb the pandemic, the industry is on track to break 2019’s highest-grossing year record of $43.6 billion.

Overall commercial gaming revenue grew nearly 500% in Q2 2021 when compared with Q2 2020, but that’s definitely not an apples-to-apples comparison given that casinos were forced to shut down last year as the worst of the pandemic began to impact the entire world. However, Q2 2021 was 26.3% higher than revenue earned in Q2 2019 also, before the Covid-19 pandemic began. On a consecutive basis, i.e., from the previous quarter (Q1 2021’s $11.13 billion), revenue grew 22.6% in Q2 2021 — therefore proving that it’s been a really strong quarter by various yardsticks.

Slot And Table Games’ Performance

Within overall revenue, combined revenues from slot and table games hit a record $11.8 billion, an increase of 9.9% from the previous high and up 12% from Q2 2019. Slot revenue recovered at a faster rate than table games, though, growing at a rate of 16.7% compared with table games’ revenue growth rate of 0.8%.

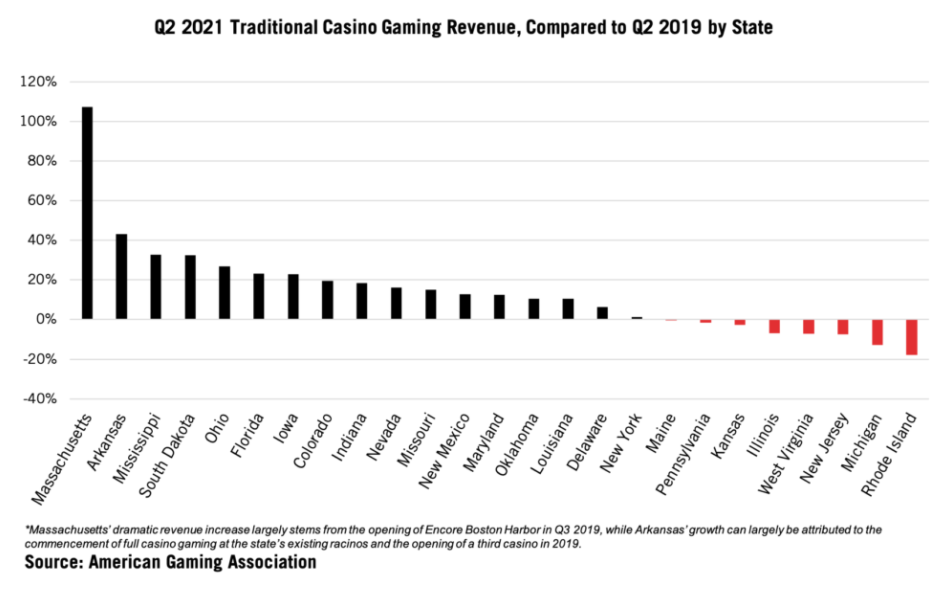

In many states, Covid-19 related regulatory restrictions generally established limits on the number of players that could be seated at any table game, with some states suspending certain table games altogether. Even with such limitations still in place during parts of Q2 2021, 17 out of 25 states experienced a jump in traditional casino gaming revenue (combined slot and table game revenue) compared to Q2 2019.

This is the second consecutive quarter that gaming revenue has outperformed the broader economy. It also has more room to grow, given most U.S. casinos were still subjected to state reopening guidelines at the start of the quarter, which significantly limited casino capacity, offerings, and amenities, the AGA said. When Q2 2021 began, 15 of 25 states that are collectively home to three-quarters of commercial casinos in the U.S. had restricted their capacity to 50% or lower. By the close of the quarter, though, they had all fully reopened.

However, gaming revenue only constitutes one segment of overall casino revenue and other aspects like live entertainment, dining, hotel bookings, and meetings and conventions are yet to fully rebound.

State-wise Spend Per Casino Visit

With consumers adopting an increasingly optimistic economic outlook during the quarter, though, the spend-per-casino-visit rate remained high. The spike in average traditional gaming revenue per admission that occurred last year after casinos reopened remains well above pre-pandemic levels, the AGA report showed. This is based in particular on data from four states: Illinois, Iowa, Louisiana, and Missouri. In Q2 2021, average quarterly casino win per visitor for all four states seemingly stabilized between 20.4% and 45.7% above Q2 2019 averages.

The second quarter of this year also saw 17 (of the 25) gaming states generate record quarterly revenue. That included 8 of the 10 highest-grossing states in 2019 — Indiana, Louisiana, Maryland, Missouri, Nevada, New York, Ohio, and Pennsylvania. Gaming revenue shrank only in three states when compared with Q2 2019. Those were Kansas (-0.5%), Maine (-2.6%), and Rhode Island (-14.7%), where the state’s two casinos only returned to full operating capacity in late May and faced a more competitive New England market.

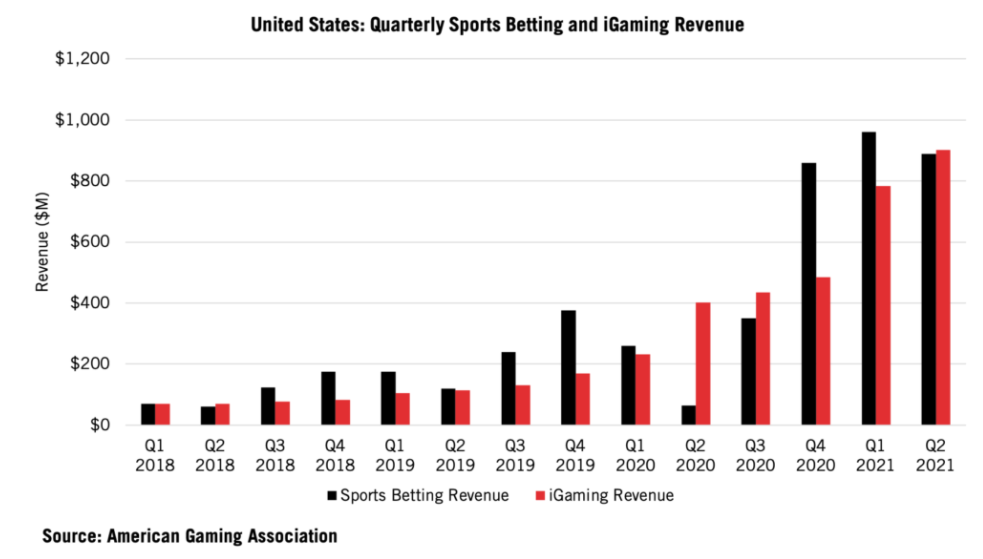

iGaming, Sports Betting Also Post Record Quarter

Meanwhile, iGaming continued to set new records, reaching $901 million during Q2 2021 (up 14.9% from Q1 2020) even as sports betting had its second-best quarter to date, the AGA said. Sports betting generated $888.9 million in Q2 2021, an increase of more than 600% over Q2 2019. Since Q2 2019, 12 states and the District of Columbia have launched commercial sports betting markets.

Just yesterday — i.e., Aug. 10 — we wrote about how sportsbooks crossed $300 million in operator revenue only for the fourth time since the Professional and Amateur Sports Protection Act (PASPA) law was struck down in mid-2018.

Combined revenue from sports betting and iGaming accounted for 13.1% of total gaming revenue in Q2 2021, down slightly from 15.7% in Q1 2021.

In the first six months of 2021, iGaming — legal and active in only six states — generated $1.66 billion in revenue, growing 160.8% from the same period in 2020 and already surpassing last year’s full year total of $1.55 billion. Similarly, first-half sports betting revenue in 2021 reached $1.85 billion, overtaking 2020’s full year total of $1.55 billion, the AGA said.

Las Vegas, the center of the country’s casino industry, has seen increases in tourism, gaming revenue, and airline passenger totals over the past several months, Casino.org reported. The $4.3 billion Resorts World Las Vegas also opened on the Strip this summer. It is the most expensive hotel-casino in the state’s history, and the first new resort to open on the Strip since 2010. Its grand opening in June had an estimated 20,000 visitors.

Still, challenges from the Covid-19 pandemic have not quite been left behind. Health officials in Los Angeles, Chicago, and Hawaii recently cautioned against traveling to Las Vegas because of Southern Nevada’s low vaccination rate and large number of new infections, Casino.org says in its report.

“These first half results are truly remarkable. COVID-19 is not yet in the rearview mirror, but I’m confident the record first half of 2021 has laid a strong foundation for the industry’s full recovery. We’ve had a setback for sure with the Delta variant and some challenges with vaccinations, but I think we’re going to get through it,” AGA President and chief executive officer Bill Miller said on Tuesday.