The Cannabis Administration and Opportunity Act: What You Need To Know About The Newly Released Draft Bill

By a Biometrica staffer

On Wednesday, July 14, Senate Majority Leader Chuck Schumer, Sen. Cory Booker, and Sen. Ron Wyden unveiled a draft of their bill to legalize marijuana at the federal level. The proposal seeks to remove the drug from the Controlled Substances Act and impose a federal tax on marijuana products.

Titled the “Cannabis Administration and Opportunity Act,” the draft of this long-anticipated Senate bill was released by the sponsors to seek public input to improve it before it is formally introduced on the floor. At the outset, it’s important to remember that while this is a key step towards decriminalizing marijuana at the federal level, this piece of news does not mean anything will change immediately, or even in the near term. The public will be able to comment on the bill until Sept. 1.

Schumer, Wyden, and Booker had previously spoken about releasing a draft legislation of this kind in February. In December 2020, congressional leaders voted overwhelmingly to decriminalize cannabis at the federal level. But the bill failed to pass the Senate at that time. In May this year, congressional leaders reintroduced a bill to strike marijuana from the list of controlled substances and invest in communities disproportionately affected by the “drug war,” NBC News reported.

The Marijuana Opportunity Reinvestment and Expungement Act of 2021, also known as the MORE Act, was introduced by House Judiciary Committee Chairman Jerry Nadler. Of the vote count in December, 222 Democrats were in favor of passing the MORE Act and six were against it. Five Republicans voted in favor of it and 158 voted against passing it.

According to the new draft Senate bill, which runs 163 pages, the aim is: “to decriminalize and deschedule cannabis, to provide for reinvestment in certain persons adversely impacted by the War on Drugs, to provide for expungement of certain cannabis offenses, and for other purposes.” It goes on to say that the Congress finds that communities that have been most harmed by cannabis prohibition are benefitting the least from the legal marijuana marketplace. A legacy of racial and ethnic injustices, compounded by the disproportionate collateral consequences of cannabis prohibition enforcement, now limits participation in the industry, it adds.

Legal cannabis businesses support over 321,000 jobs in the country, according to the draft bill. But the continued enforcement of cannabis prohibition laws results in over 600,000 arrests annually, and disproportionately impacts people of color who are four times more likely to be arrested for it than their white counterparts, despite equal rates of use across demographics, the bill continues.

As with the MORE Act, this new bill also is expected to face a contentious battle ahead. It is generally opposed by Republicans and by some moderate Democrats, and has not received an endorsement from President Joe Biden, CNBC says in its report. It will require 60 votes, including at least 10 GOP votes, to pass through the Senate.

Here are a few important aspects of the new draft Senate bill:

- To summarize, it would federally deschedule cannabis, expunge prior convictions of nonviolent cannabis offenders, allow people serving time in federal prison for nonviolent marijuana crimes to petition for resentencing, maintain the authority of states to set their own marijuana policies, and remove collateral consequences like immigration-related penalties for people who’ve been criminalized over it.

- A gradual federal tax rate would be imposed on marijuana sales, starting at 10% for the first year after the bill’s enactment and the first subsequent calendar year. Then it would be increased annually, rising from 15% to 20% to 25%. Meanwhile, small cannabis producers with less than $20 million in sales annually would be eligible for a 50% reduction in their tax rate, via a tax credit.

- The bill also lays out a structure for how marijuana businesses will be approved and regulated. Companies selling taxable marijuana products, or cannabis at the wholesale level, for instance, would require Treasury Department approval. Marijuana producers would further need to be registered with FDA.

- The bill also calls for the creation of an Opportunity Trust Fund from new tax revenue, like the MORE Act did, in order to invest in programs for communities most affected by the “failed War on Drugs.”

- Under the bill, the regulation of marijuana use is slated to be transferred away from the Drug Enforcement Administration to the Food and Drug Administration and other agencies.

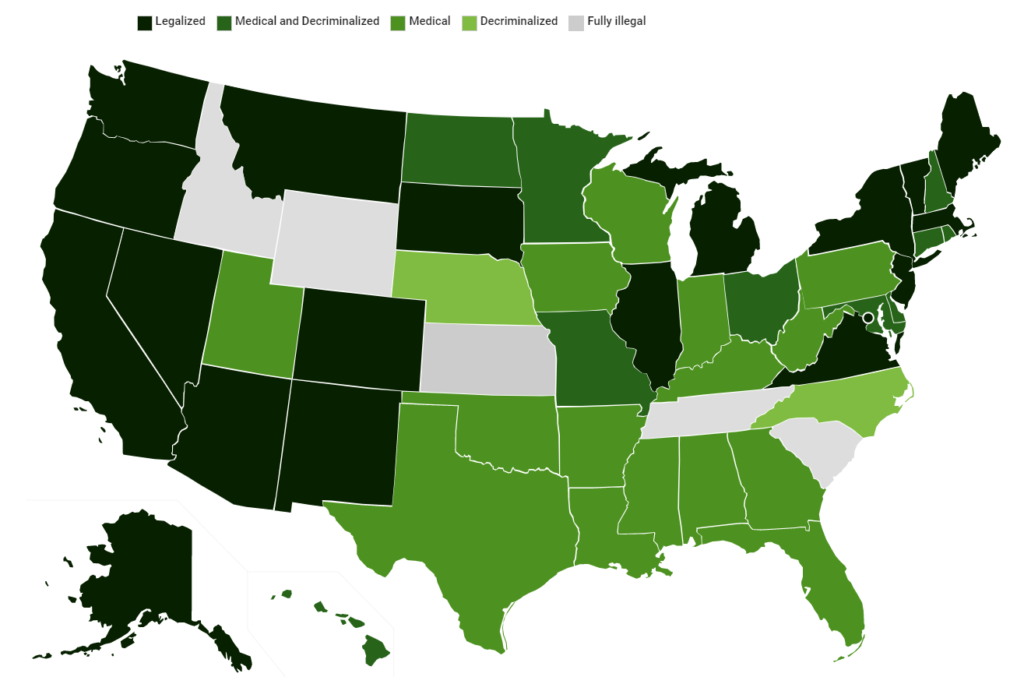

- While states are still allowed to set their own cannabis laws, businesses and individuals in those that have legalized it will be allowed to sell and consume marijuana without the risk of federal punishment, Axios says.

- States that have not legalized it cannot stop businesses from transporting cannabis products across their borders to other states where it is permitted, Marijuana Movement points out in its detailed article on the draft bill.

- The proposed legislation requires federal districts to expunge nonviolent marijuana-related arrests and convictions within one year. It requires the attorney general to remove marijuana from the Controlled Substances Act within 60 days of it being enacted.

- It would authorize physicians with the U.S. Department of Veterans Affairs to issue recommendations for medical cannabis to veterans.

A Gallup survey last November found that Americans are more likely now than at any point in the past five decades to support the legalization of marijuana. What happens to the Cannabis Administration and Opportunity Act, though, and what form it finally takes remains to be seen.